Payroll Withholding: A Primer for Employers

BerniePortal

JUNE 2, 2022

To employees, payroll may seem pretty straightforward. Employers, on the other hand, know how complicated payroll can get, especially when it comes to withholding taxes.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

BerniePortal

JUNE 2, 2022

To employees, payroll may seem pretty straightforward. Employers, on the other hand, know how complicated payroll can get, especially when it comes to withholding taxes.

Business Management Daily

JULY 19, 2021

Regardless, you can’t put payroll on hold simply because things are confusing. Our third-party payroll provider , however, is resisting including the credit on our second-quarter 941, saying it’s still waiting for more information from the IRS. Remote work and payroll software. COBRA tax credits. What you need to know.

Business Management Daily

JUNE 28, 2024

As many of these young workers may be taking on their first job, employers must remember some important payroll considerations. First-Job Jitters It’s natural for employers and young employees to experience some jitters regarding payroll. A clear understanding of the basics can help alleviate those concerns.

Business Management Daily

MARCH 3, 2023

Tax credits vs. tax deductions The end result of taking tax credits and tax deductions is basically the same: You will pay less tax. But there is a difference between the two: Tax deductions reduce your taxable income. Any item you take as a tax credit can’t be used again as a tax deduction. In 2023, this amount is $2.89

Qandle

SEPTEMBER 20, 2023

Payroll taxes are a crucial aspect of every employer’s financial responsibilities. Understanding which payroll taxes employers are responsible for is essential for compliance and financial planning. Looking for the Best Payroll ? Check out the Payroll Software. For high-income earners, an additional 0.9%

HR Lineup

APRIL 1, 2024

Managing international payroll can be complex due to differences in tax laws, regulations, and currency exchange rates. One essential aspect of managing international payroll is the concept of shadow payroll. What is Shadow Payroll? How Does Shadow Payroll Work?

Qandle

DECEMBER 16, 2023

Payroll refers to the process by which employers calculate and distribute compensation to their employees for the work they have completed. It involves various tasks, including calculating wages, withholding taxes and other deductions, and ensuring that employees receive their net pay. Check out the Best 10 HR Software.

Qandle

MAY 16, 2023

If you are a business owner, HR manager, or payroll administrator in India, understanding payroll processing is essential for your business’s smooth operation. From calculating employee salaries to managing taxes and deductions, payroll processing is a critical aspect of any business. What is payroll?

Qandle

NOVEMBER 27, 2023

Payroll management is a critical aspect of running a successful business, ensuring that employees are compensated accurately and on time. This guide aims to provide a comprehensive overview of payroll management in a concise manner. Looking for the Best Payroll Management ? Check out the Payroll Management.

Qandle

AUGUST 3, 2023

Payroll processing is a critical function in any organization, including those operating in India. This guide presents a comprehensive step-by-step procedure for payroll processing in India, including the techniques and stages involved. Looking for the Best Payroll Software ? Check out the Payroll Software.

HR Bartender

JANUARY 18, 2022

Payroll Mistakes Erode Trust. When it comes to building trust specifically inside the organization, a place to start could be the payroll process. In a Harris Poll survey commissioned by Paycom, 91% of respondents said that when payroll is incorrect, it breaks the trust employees have in their employer. Enjoy the read).

HR Lineup

JULY 19, 2023

Plus Minus Payroll is a comprehensive and user-friendly payroll management software designed to simplify and streamline the payroll process for businesses of all sizes. It offers a range of powerful features and tools that automate various payroll tasks, ensuring accuracy, efficiency, and compliance.

Qandle

SEPTEMBER 19, 2023

Payroll is an integral part of every business, regardless of its size. It involves the calculation, processing, and distribution of employee salaries, taxes, and other deductions. In this blog, we will delve into the concept of payroll and explore how Qandle can be your ultimate solution for all your payroll requirements.

HR Lineup

DECEMBER 1, 2023

In the ever-evolving landscape of business management, contractor payroll software plays a pivotal role in ensuring seamless and efficient payment processing for businesses that engage with external contractors. With its contractor payroll features, Zoho Books enables precise payment processing, tax calculations, and expense tracking.

Qandle

JUNE 20, 2023

Pre-payroll activities refer to the tasks and processes that need to be completed before running the actual payroll for employees. Here is a detailed overview of pre-payroll activities: Data Collection: The first step in pre-payroll activities is collecting all the necessary data related to employees.

HR Lineup

JULY 18, 2023

CheckMark Payroll is a comprehensive payroll management software offered by CheckMark, Inc., Designed to simplify the complexities of payroll processing, CheckMark Payroll empowers businesses of all sizes to efficiently manage their payroll tasks while ensuring compliance with tax regulations and maintaining accurate employee records.

cipHR

MARCH 27, 2023

If you’re considering payroll outsourcing UK, it’s likely you will encounter plenty of jargon on your journey to finding the right outsourced payroll provider. Don’t forget to check out our top 10 tips for choosing the right outsourced payroll company. These are sometimes taxable, which means they will appear on payslips.

Qandle

APRIL 25, 2023

Businesses have a horrifyingly high potential for error when handling payroll manually. That’s where HR Payroll Software comes into action. A comprehensive HR Payroll Management System offers several benefits that guarantee efficacy, punctuality, consistency, and cost-effectiveness. What is Payroll?

Higginbotham

NOVEMBER 7, 2023

Since the employer–employee relationship is heavily regulated, employers need to comply with requirements for everything from employee safety to accommodations for disabilities. Payroll processing alone can eat up significant resources. That’s why payroll outsourcing is popular, especially among small to midsize employers.

Qandle

APRIL 7, 2022

Payroll administration is the difficult task of keeping track of your employees’ financial data, such as pay, benefits, taxes, and deductions. Calculating your employees’ salary, issuing payments, preserving payroll records, and collecting tax forms are all part of payroll management.

Bayzat

AUGUST 11, 2024

It requires a holistic approach to employee management, which includes a shift from traditional HR management systems to cloud-based HR and payroll solutions. It requires a holistic approach to employee management, which includes a shift from traditional HR management systems to cloud-based HR and payroll solutions.

Insperity

FEBRUARY 11, 2021

As an employer you shoulder a lot of responsibility, especially when it comes to employee compensation. Having a firm grasp on these responsibilities and why they are important will help you set up a payroll process that encourages accuracy and is easy to run. Decide to do payroll yourself or choose a service provider.

Patriot Software

AUGUST 3, 2022

Whether or not you want to admit it, payroll taxes should be one of your top concerns. Payroll taxes generally include Social Security and Medicare. But, many states have additional taxes that employers need to deduct from employee wages. California payroll tax […] READ MORE.

PeopleStrategy

JANUARY 17, 2024

Leap year impacts payroll, taxes, and benefits, all of which your payroll platform and other support services should be set up to handle. Changes to Payroll The good news is that if you pay your employees hourly or pay salaried employees monthly or semi-monthly (e.g. 31 for employers to furnish Form 1095-C to employees.

Business Management Daily

JULY 7, 2022

Commissioner —has a direct impact on your payroll operations, at least if you’re late filing a Tax Court petition and the reason for your tardiness was beyond your control. Hallmark Research Collective, a pot dispensary in California, deducted its expenses, like any other business does. One decision— Boechler v. Commissioner.

Benefit Resource Inc.

JUNE 20, 2019

Not all payroll deductions are created equal. Some people (although not many) may engage in a heated debate on the value of pre-tax deductions vs. post-tax deductions. Colleagues (even in our own organization) have asked “Why do we need post-tax deductions?” What is a pre-tax deduction?

InterWest Insurance Services

OCTOBER 27, 2022

The plans benefit employers, as well. Since the pre-tax benefits aren’t subject to federal social security withholding taxes, employers don’t have to pay FICA or workers’ comp premiums on those payments. A cafeteria plan can save employers an average of almost $115 per participant in FICA payroll taxes.

HR Bartender

JULY 11, 2023

I must keep my employment tax knowledge current. Payroll tax is complex and always changing. There are people and organizations who do nothing but focus on payroll taxes and they have to stay on top of the latest changes. Only this time with employment taxes. What are employment taxes? And enjoy the read.)

InterWest Insurance Services

MARCH 22, 2022

The deadline is fast approaching for employers with 5 or more workers in California, and who do not already offer their employees a retirement plan, to register their staff for the CalSavers Retirement Savings Program. Employers with 50 or more workers – The deadline for registration was June 30, 2021. Employers can register here.

Qandle

NOVEMBER 9, 2023

Single Touch Payroll (STP) is a reporting system developed by the Australian Taxation Office (ATO) that requires employers to report their employees’ salary and wage information, superannuation contributions, and pay-as-you-go withholding (PAYGW) information directly to the ATO each time they run their payroll.

Hppy

MARCH 15, 2023

Payroll problems can be a thorn in the side of any business, so it’s important to have a plan of action in place to either avoid them entirely, or remedy them as and when they arise. Handling Incorrect Deductions from Employees’ Salaries Incorrect deductions can be a huge headache for employers and employees alike.

HR Lineup

JULY 11, 2023

Deluxe Corporation, a renowned provider of business services, offers a comprehensive Payroll and HR solution. This platform is designed to assist organizations in streamlining their payroll processes and managing human resources efficiently. At the core of Deluxe’s Payroll and HR offering is a robust payroll management system.

Global People Strategist

DECEMBER 4, 2023

Ireland’s employment laws are designed to protect employees’ and employers’ rights and interests. These laws encompass various topics, including employment contracts, working hours, wages, and workplace safety. Irish employment law sets limits on working hours to ensure employees’ well-being.

CorpStrat

NOVEMBER 4, 2022

Don’t leave your Year-End Payroll to the last minute. Even if you’re a Year-End Payroll veteran, it can still be easy to overlook crucial steps. What is Year-End Payroll? Businesses are responsible for Year-End Payroll. Please contact payroll@corpstrat.com if you find any discrepancies. ACA Reporting.

Abel HR

DECEMBER 8, 2020

One of the most perplexing topics in the human resources industry is that of the payroll tax. Both employer and employee know about it but unsure of what it is and where it goes. What are Payroll Taxes? Simply put, payroll taxes are taxes paid on the wages and salaries of a company’s employees. Self-Employment Tax.

Bayzat

JUNE 2, 2024

It ensures employers pay employees’ wages on time and exposes defaulters. Undoubtedly, HR and payroll managers need to familiarize themselves with WPS to improve employee care, avoid defaults, and run the company better. UAE employers upload employee wage files to the database, and MoHRE and Central Bank validate the information.

Hppy

MAY 29, 2018

Employers have the responsibility to accurately calculate payroll deductions and pay employee benefits taxes. Also, of course, getting their wages right is crucial to being a good employer. Payroll Deductions. To help you to calculate your deductions you can use this payroll deductions online calculator.

CorpStrat

JULY 30, 2021

What if we told you there was a way you can deduct all of the medical expenses that are not covered by your insurance plan. We’re talking about things like deductibles, co-insurance, doctor visits, doctor’s who don’t take insurance, eyeglasses, therapy, etc. Doesn’t that sound interesting? Sole Proprieters.

Professionals Alternative

SEPTEMBER 25, 2023

[link] Boost Your Career as a Payroll Assistant: Excel Skills Every Budget Professional Should Master Introduction As a payroll assistant, I have come to understand the crucial role that Excel skills play in my daily work. Payroll processing involves handling vast amounts of data, calculations, and complex formulas.

InterWest Insurance Services

JUNE 20, 2024

The IRS updates this amount annually, along with minimum deductibles as well as the out-of-pocket maximums for high-deductible health plans. They can put money into their HSA through pre-tax payroll deductions, deposits or transfers. for individual HSA plans. Funds roll over from year to year and can earn interest.

Abel HR

DECEMBER 8, 2020

One of the most perplexing topics in the human resources industry is that of the payroll tax. Both employer and employee know about it but unsure of what it is and where it goes. What are Payroll Taxes? Simply put, payroll taxes are taxes paid on the wages and salaries of a company’s employees. Self-Employment Tax.

Ascender

JUNE 20, 2018

It is time for businesses to get ready for Single Touch Payroll (STP), a new legislation being introduced on 1 July 2018. The new legislation changes the way the Australian government requires businesses to report payroll information to the Australian Taxation Office (ATO), as part of the government’s digital-first initiative.

Business Management Daily

DECEMBER 1, 2019

Hourly-paid nonexempts are impacted only to the extent of withholding and deductions. This avoids the problem, but many payroll systems aren’t set up to deal with these fractions. Lastly, check employment contracts and engagement letters to determine whether employees were promised a set annual salary. What’s up with this math?

Workers' Compensation Perspectives

SEPTEMBER 30, 2019

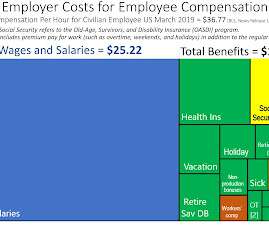

“Payroll” used to have a simple meaning. According to the Online Etymology Dictionary: payroll (n.) For workers’ compensation, payroll can have different meanings depending on your jurisdiction and whether you are a worker or an employer. Wages and salaries cost employers $25.22

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content