How the Next Executive Order Could and Should End Employer-based Health Insurance by 2023

Joe Markland

OCTOBER 11, 2020

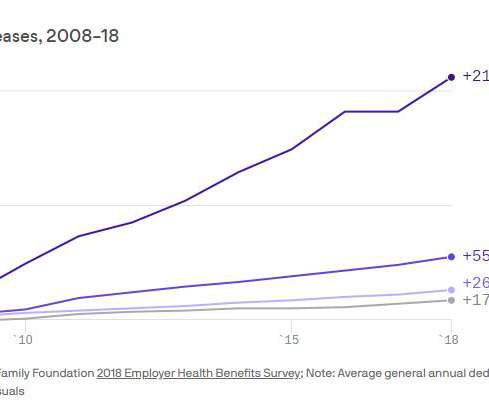

Over the past 6 years I have published several articles on the need to personalize health insurance (and get the employer out of the way) by making an individual insurance policy tax deductible. First, I will say that employers are over-buying insurance for most employees.

Let's personalize your content