Reconsidering your employee benefits priorities

Health Consultants Group

OCTOBER 1, 2021

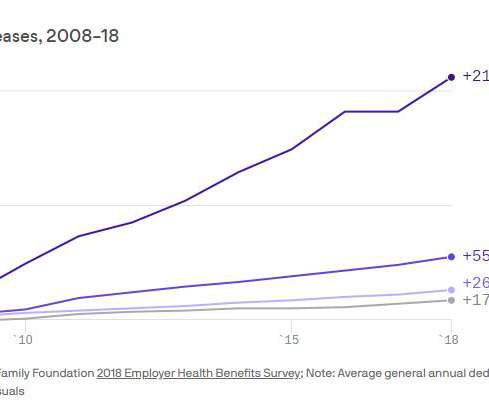

Reconsidering your employee benefits priorities. As your employees settle into their post-pandemic workflow, you’re probably noticing that they don’t want business-as-usual. But, unfortunately, you won’t be able to offer enough benefits to retain every dissatisfied employee. What do employees want?

Let's personalize your content