How the Next Executive Order Could and Should End Employer-based Health Insurance by 2023

Joe Markland

OCTOBER 11, 2020

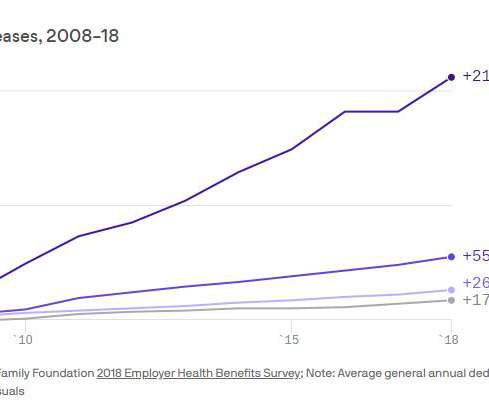

Over the past 6 years I have published several articles on the need to personalize health insurance (and get the employer out of the way) by making an individual insurance policy tax deductible. In Massachusetts, the average individual insurance buyer is choosing a plan that is 14.4% – 33.7% health insurance system.

Let's personalize your content