FFCRA and Coronavirus Paid Sick Leave: Q & A for Employers

Patriot Software

MARCH 27, 2020

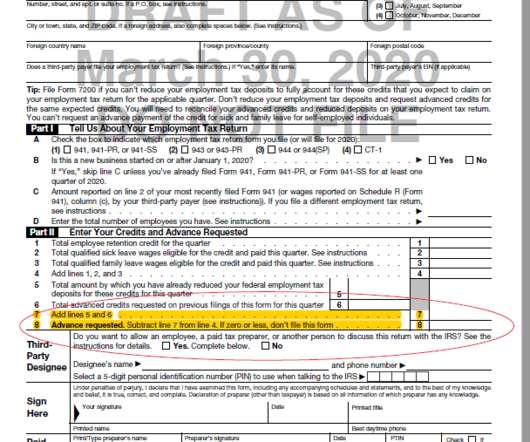

One thing small businesses must legally do is offer paid sick leave to employees impacted by the coronavirus disease (COVID-19). The Families First Coronavirus Response Act (FFCRA), signed into law on March 18, 2020, requires that qualifying businesses provide this […].

Let's personalize your content