3 Reasons to Boost Your Employee Benefits Offerings in 2020

Achievers

DECEMBER 16, 2019

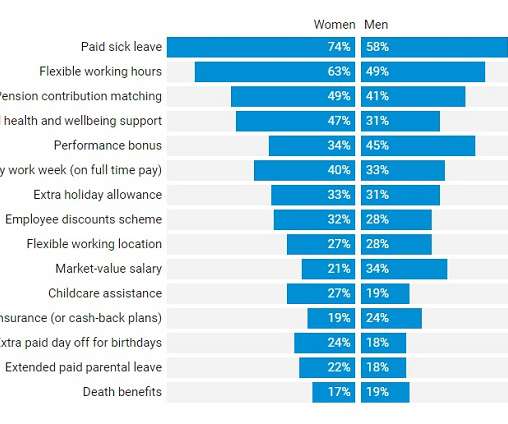

For 41 percent of small business employees, benefits are crucial when accepting a new job, second to salary. A matching 401(k) or pension. Really, if your business is doing well and 2019 was a successful year, there’s no good reason to be stingy with the benefits in 2020. Use of a company car. Free healthcare coverage.

Let's personalize your content