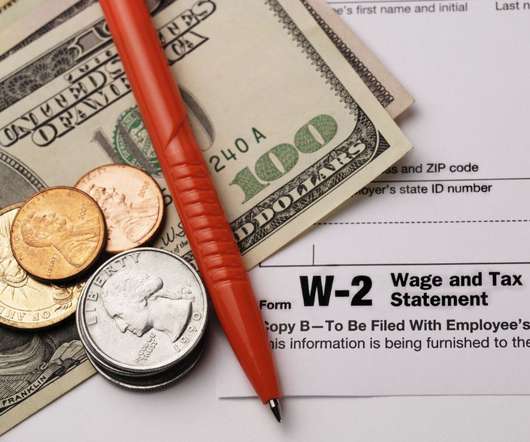

Common Tax Forms Employers Need to Know: A Complete Guide

HR Lineup

APRIL 23, 2024

In business operations, particularly for employers, navigating the intricacies of tax compliance is paramount. Understanding the various tax forms required by the Internal Revenue Service (IRS) is essential to ensure accuracy and avoid penalties. Employees complete this form to indicate their federal income tax withholding preferences.

Let's personalize your content