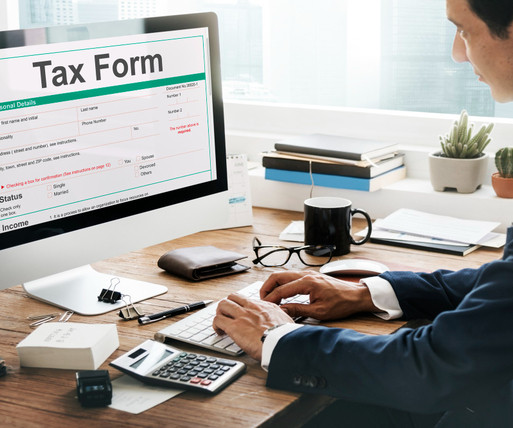

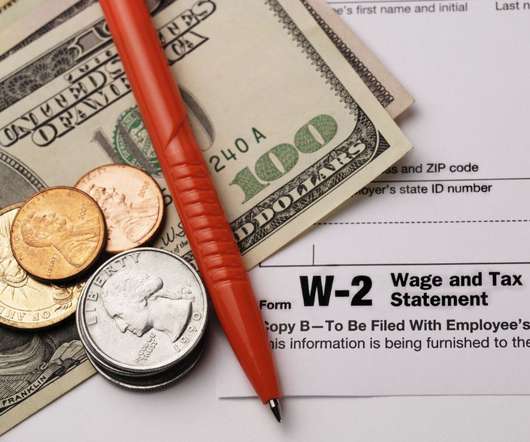

Compliance TV: President Signs Infrastructure Bill That Ends ERC Early

PayrollOrg

JANUARY 25, 2022

In this December 2021 issue of Compliance TV: President signs infrastructure bill that ends ERC early; Reminder that payment of deferred social security tax from 2020 Is due soon; IRS announces 2022 retirement plan contribution and benefit limits; and IRS announces 2022 COLAs for transportation fringes, FSA deferrals, foreign earned income exclusion, (..)

Let's personalize your content