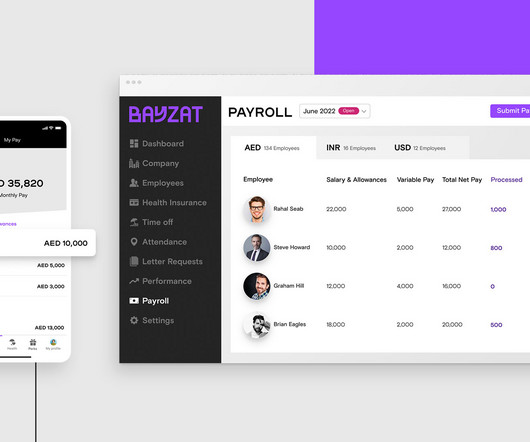

Top 10 Enterprise Payroll Software in 2023

HR Lineup

SEPTEMBER 21, 2023

Payroll management is critical for businesses of all sizes, but it becomes especially complex for enterprises with a large workforce. In 2023, enterprise payroll software has evolved to offer advanced features that streamline the payroll process, ensure compliance with tax regulations, and enhance employee self-service options.

Let's personalize your content