59% of British workers feel unhappy with their benefits packages

Employee Benefits

OCTOBER 24, 2023

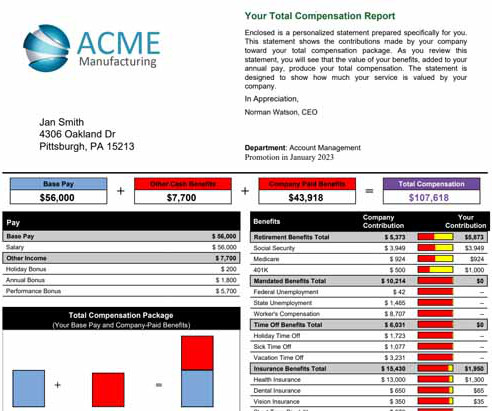

Almost six in 10 (59%) British workers feel unhappy, dissatisfied, highly dissatisfied or neutral with their benefits packages , according to new research. As many as 49% are optimistic that they will receive a salary increase in 2024, and 70% of employers plan to increase salary offers in 2024 for certain in-demand roles.

Let's personalize your content