My Final Quarterly Webinar Summary of 2024

Money Talk

DECEMBER 27, 2024

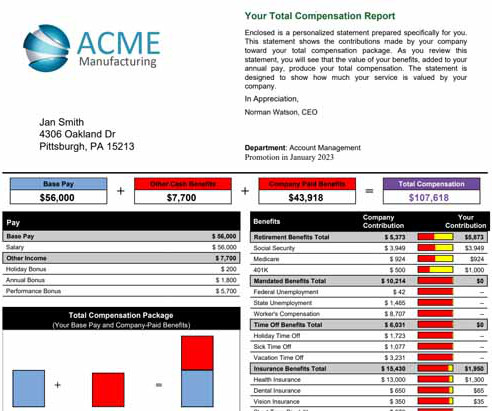

As 2024 winds down next week, its time for my final quarterly summary of take-aways from recent personal finance classes, conferences, and webinars that I attended. Below are some nuggets that you might find useful in your personal financial planning: Offense and Defense- Financial offense involves earning money from one or more sources (e.g.,

Let's personalize your content