IRS Announces 2024 Retirement Plan Contribution, Benefit Limits

PayrollOrg

NOVEMBER 2, 2023

The IRS announced the changes to the dollar limits on benefits and contributions under qualified retirement plans for tax year 2024.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

PayrollOrg

NOVEMBER 2, 2023

The IRS announced the changes to the dollar limits on benefits and contributions under qualified retirement plans for tax year 2024.

Proskauer's Employee Benefits & Executive Compensa

NOVEMBER 3, 2023

On November 1st, the IRS released a number of inflation adjustments for 2024, including to certain limits for qualified retirement plans. The table below provides an overview of the key adjustments for qualified retirement plans.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

International Foundation of Employee Benefit Plans

JULY 9, 2024

So far in 2024, the Department of Labor (DOL) has released proposals for plan administrators to populate a missing participant database and automatic portability of retirement plan accruals when employees change jobs.

Money Talk

JUNE 13, 2024

With the 2023 tax filing deadline in the rear view mirror, now is a good time to look ahead to 2024 taxes that you will owe in April 2025. This post extends that discussion with a description of seven key steps to take to plan for your 2024 tax return due in 2025. 401(k) plan).

HR Lineup

OCTOBER 21, 2024

Below are the top 10 employee benefits certifications for professionals in 2024. Administered by the International Foundation of Employee Benefit Plans (IFEBP) and Dalhousie University, this program provides a comprehensive education on employee benefits, retirement plans, and health benefits. Strong focus on U.S.

Best Money Moves

MARCH 11, 2024

The 4 best benefits in 2024, according to employees. Here are the 4 best benefits in 2024, according to employees. Here are the best benefits in 2024 based on input from real workers. Average healthcare premiums for American families increased 7% in 2024, according to research from KFF.

HR Lineup

OCTOBER 20, 2024

In 2024, the HR outsourcing landscape offers a variety of providers with comprehensive solutions tailored to meet the needs of businesses of all sizes. Below are the ten best HR outsourcing services and companies to consider in 2024. Top 10 HR Outsourcing Companies in 2024 1. What is HR Outsourcing?

Proskauer's Employee Benefits & Executive Compensa

JANUARY 16, 2024

Act of 2022 (“SECURE 2.0”), the IRS issued Notice 2024-02 , which addresses SECURE 2.0 implementation issues and extends the plan amendment deadline. Although Notice 2024-02 offers helpful guidance for employers and plan administrators, it does not include hotly anticipated guidance on SECURE 2.0 Before SECURE 2.0,

HR Lineup

OCTOBER 17, 2024

Here are the top 10 compensation courses and certifications you should consider in 2024 to bolster your expertise and career. Key Features: Core curriculum on compensation and benefits planning. Includes topics such as retirement planning, health benefits, and executive compensation.

Business Management Daily

AUGUST 30, 2023

brings to your retirement plans in 2023. It used to be that all employees eligible for the company’s retirement plan would have to receive notices; now that requirement is reduced to only enrolled employees. already made to your retirement plans appeared first on Business Management Daily.

HR Lineup

MAY 28, 2024

As we step into 2024, the landscape of employee benefits and perks is continuously evolving. These programs go beyond the traditional healthcare and retirement plans, incorporating elements that cater to employees’ holistic well-being. The post Top 10 Employee Perks Programs for 2024 appeared first on HR Lineup.

Best Money Moves

DECEMBER 5, 2023

2024 Employee benefits trends: Focus on employee wellbeing. Here are the top 2024 employee benefits trends. 4 Top 2024 Employee Benefits 1. According to Morgan Stanley, financial stress in employees can lead to declines in productivity, weakened company culture and delayed retirement, among other risks.

Money Talk

JULY 13, 2023

Act of 2022 , passed last December, has financial planning opportunities for both the accumulation and distribution phases of retirement planning. This rule takes effect in 2024 and Roth IRA income limits do not apply. The match money goes into a worker’s retirement plan, not to pay off debt. The SECURE 2.0

Benefits Notes

NOVEMBER 21, 2023

On November 1, 2023, the Internal Revenue Service (IRS) released Notice 2023-75 , which sets forth the 2024 cost-of-living adjustments affecting dollar limits on benefits and contributions for qualified retirement plans. The following chart summarizes the 2024 limits for benefit plans.

Money Talk

AUGUST 8, 2024

With less than five months remaining in 2024, now is the time to begin serious tax planning for your 2024 income tax return. Beware QCD Reporting Errors - The problem is that 1099-R forms for retirement plan withdrawals only show the gross distribution amount and not the amount that taxpayers age 70.5+

Money Talk

AUGUST 1, 2024

I’ve solely authored three personal finance trade books so far during my life and 2024 is a milestone year. 2024 is the anniversary of Saving On A Shoestring (my first book published 30 years ago in 1994) and Investing On A Shoestring (published 25 years ago in 1999).

Money Talk

DECEMBER 7, 2023

As the year winds down so, too, does your opportunity to take proactive steps to reduce 2023 income tax due in April 2024 and, perhaps, taxes due in future years as well. Below are some money-saving tax planning strategies to consider. tax-deferred retirement plan contributions and charitable gifting) are already accounted for.

McDermott Will & Emery Employee Benefits

NOVEMBER 1, 2023

The Internal Revenue Service recently announced the cost-of-living adjustments to the applicable dollar limits for various employer-sponsored retirement and welfare plans for 2024. Certain health and welfare plan limits have not yet been released.

WEX Inc.

JUNE 11, 2024

News & World Report , a global authority in rankings and consumer advice, has named WEX one of the 2024-2025 Best Companies to Work For. The 2024-2025 list includes companies that received high scores on multiple metrics that make up a positive work environment and everyday employee experience.” For investor relations, go here.

HR Lineup

NOVEMBER 24, 2023

In this article, we will delve into the ten best HR compliance software tools in 2024, providing an in-depth analysis of their features and capabilities. Top 10 HR Compliance Software in 2024 1. The post 10 Best HR Compliance Software 2024 appeared first on HR Lineup. What is HR Compliance Software?

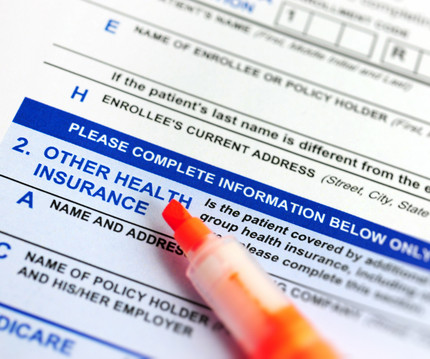

PeopleStrategy

DECEMBER 12, 2023

That means you need to be acutely aware of changes, such as new annual limits on contributions and required coverage in 2024. For plan years beginning in 2024, the minimum annual deductible is $1,600 for self-only coverage and $3,200 for family coverage.

McDermott Will & Emery Employee Benefits

NOVEMBER 10, 2023

On November 9, 2023, the Internal Revenue Service (IRS) announced cost-of-living adjustments to the applicable dollar limits for certain health and welfare plan benefits, including those for health flexible spending arrangements and commuter benefit plans, among other important updates.

HR Lineup

JUNE 9, 2024

Here, we explore the ten best employee database software in 2024, evaluating their features, benefits, and potential drawbacks to help you make an informed decision. This includes handling health insurance, retirement plans, paid time off, and other employee perks.

Employee Benefits

MARCH 1, 2024

The top 10 most-read articles on employeebenefits.co.uk The top 10 most-read articles on employeebenefits.co.uk

Proskauer's Employee Benefits & Executive Compensa

NOVEMBER 20, 2023

On November 9th, the IRS announced additional inflation adjustments for 2024, including to the annual contribution and carryover limits for healthcare flexible spending accounts and the monthly limit for qualified transportation fringe benefits. The new limits are set forth below.

Benefits Notes

AUGUST 9, 2022

On August 3, 2022, the IRS published Notice 2022-33, which extends the deadlines for amending retirement plans and IRAs to reflect certain changes to the law made by the SECURE Act; the Bipartisan American Miners Act; and section 2203 (allowing waiver of 2020 required minimum distributions) of the CARES Act. December 31, 2025.

McDermott Will & Emery Employee Benefits

JANUARY 3, 2024

Beginning in 2024, employers and plan sponsors will need to implement new minimum eligibility rules, enacted by the SECURE and SECURE 2.0 Acts, that significantly expand eligibility for long-term, part-time employees to participate in employer-sponsored retirement plans.

McDermott Will & Emery Employee Benefits

DECEMBER 20, 2023

The Internal Revenue Service (IRS) recently issued new guidance clarifying key aspects of the broadened retirement plan eligibility rule for long-term, part-time employees under the SECURE 2.0

WEX Inc.

OCTOBER 1, 2024

Keep reading and watch our Benefits Buzz podcast below as we celebrate HSA Day 2024 and dive into the real-life experiences of HSA users and share expert insights to help you and your employees make informed decisions that improve health and secure financial futures. The post HSA Day 2024: Empower your health. Secure your future.

McDermott Will & Emery Employee Benefits

OCTOBER 1, 2024

Last month, the Internal Revenue Service (IRS) released long-awaited guidance on matching contributions for qualified student loan payments under § 401(k) of the Internal Revenue Code and other similar retirement plans.

McDermott Will & Emery Employee Benefits

APRIL 4, 2024

In late December 2023, the Internal Revenue Service (IRS) issued Notice 2024-2 (the Notice), providing guidance on key provisions of the SECURE 2.0 Act of 2022 (SECURE 2.0). Provisions appeared first on EMPLOYEE BENEFITS BLOG.

Business Management Daily

MAY 9, 2024

In it, she breaks down all the new payroll compliance changes affecting payroll administration in 2024, including post-pandemic trends that don’t appear to be going anywhere anytime soon. Without further ado, here’s step-by-step guidance for achieving payroll compliance in 2024. How does it do that?

Insperity

OCTOBER 10, 2023

To do this, the law makes broad changes to the foundation of retirement preparation in the U.S.: employer-sponsored 401(k) plans. All company retirement plans started in 2023 and thereafter must have an automatic enrollment and escalation provision – also known as “ you’re in unless you’re out.” The SECURE 2.0

Employee Benefits

DECEMBER 20, 2023

The current economic environment is causing disruption to the retirement plans of many. It is important that those retiring in 2024 understand their options, make informed decisions, and avoid making mistakes with their hard-earned savings. Pension Wise offer free appointments to talk about someone’s pension options.

Employee Benefits

JUNE 28, 2024

The technology firm surveyed 250 full-time employees and HR leaders between the ages of 18 and 65 for its 2024 State of employee financial wellness report. While many employers (41%) plan to spend more on financial education and planning offerings next year than they are now, only 18% of employees are interested in what they are investing in.

Money Talk

APRIL 11, 2024

The 2023 income tax filing deadline is only days away (April 15, 2024 in most of the U.S.). RMD Inevitability - Required minimum distributions (RMDs) are inevitable if you have a traditional IRA (unless you make qualified charitable distributions), SEP-IRA, or qualified employer retirement plan (i.e., There is no way out.

Vantage Circle

SEPTEMBER 3, 2024

List of the Best 360 Degree Feedback Software in 2024 Primalogik : Best for customizable 360-degree feedback templates that can be easily tailored to fit your organization's specific needs. Recommended For: SMBs looking for an easy to use and continuous 360-degree feedback solution.

Empuls

AUGUST 27, 2024

In this all-encompassing guide, we look at the best available options concerning Employee Benefits Options in 2024, different types, and significance, along with best practices in designing a benefits package to suit the workforce's needs.

Employee Benefits

SEPTEMBER 20, 2024

More than half (55%) of employees said a retirement plan is more important than ever as 49% of workers aged 50 and older have already started phasing into retirement, according to research by global advisory and broking firm Willis Towers Watson (WTW).

Benefits Notes

AUGUST 29, 2023

Act of 2022 (“SECURE 2.0”) required that effective as of January 1, 2024 , participants in 401(k) plans, 403(b) plans, or governmental 457(b) plans, who were age 50 or older and whose Social Security wages for the previous year exceed $145,000 (indexed), only be permitted to make catch-up contributions under such plans on a Roth (after-tax) basis.

Hppy

JUNE 7, 2018

Retirement doesn’t feel like a realistic goal for many employees today. Of those over 65, nearly 19 percent were working as of 2017 , and by 2024, that number increases to 36 percent of those between 65 and 69 needing to work. workers, 79 percent expect they will need to supplement retirement income by working.

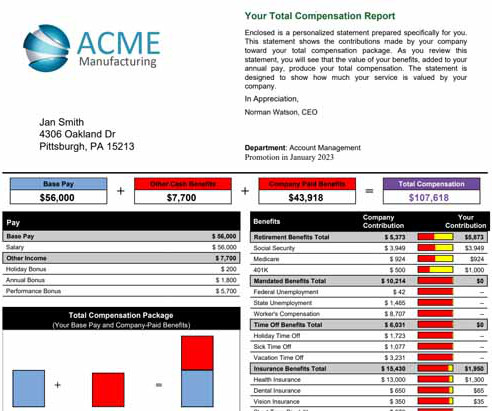

COMPackage

NOVEMBER 3, 2024

Benefits: A detailed breakdown of employer-sponsored benefits like health insurance, paid time off (PTO), retirement plans, and wellness programs. Salaried Workers: Focus on annual salary, bonus potential, retirement plan options, and detailed benefit summaries.

Empuls

JANUARY 29, 2024

This article will highlight the importance of and discuss some employee retention trends to watch out for in 2024. Meanwhile, there’s a Gallagher report predicting the state of employee retention in 2024. What are the employee retention trends in 2024? What is employee retention and why does it matter?

Benefits Notes

DECEMBER 28, 2022

Congress made several changes to retirement plans as part of the Consolidated Appropriations Act of 2023 , which recently passed both the House and Senate. The final bill contains several provisions affecting retirement plans under Division T of the bill titled “Secure 2.0 Act of 2022.” Increase in Cash-out Limit.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content