Fringe Benefits: A Guide to Understanding and Leveraging Employee Perks

HR Digest

MARCH 12, 2025

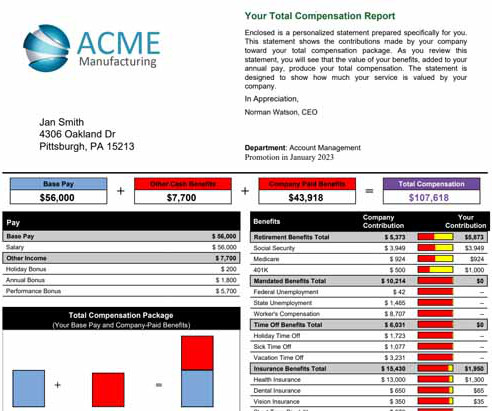

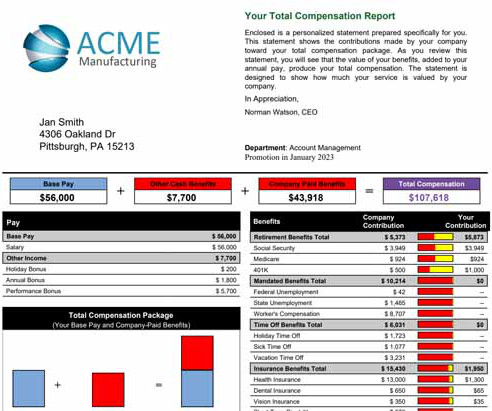

Think medical, dental, and vision insurance, often supplemented by wellness programs like mental health support or fitness stipends. 401(k) matching), stock options, or performance bonuses. In an era of rising healthcare costs, these benefits are non-negotiable for many workers.

Let's personalize your content