What Is a Qualified Retirement Plan?

HR Lineup

MARCH 13, 2022

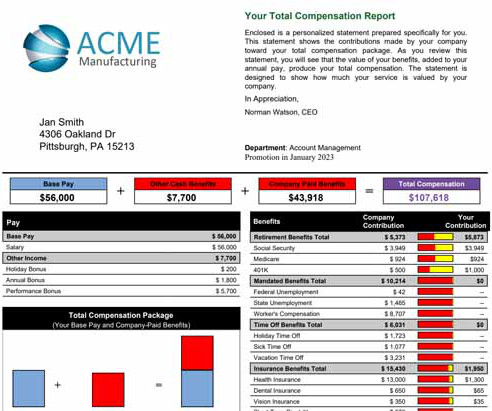

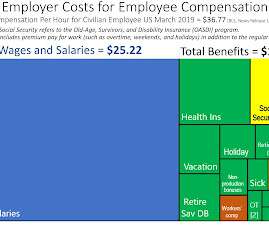

However, the tax deduction is limited to a maximum of 25% of the total salary of the employees in this qualified employee benefit plan. Nonetheless, some common examples include: 401(k). SEP – Simplified Employee Pension. As an employer, your contributions towards a qualified plan are tax-deductible. Hybrid plan.

Let's personalize your content