Individual Retirement Accounts: What You Need to Know

Money Talk

APRIL 11, 2024

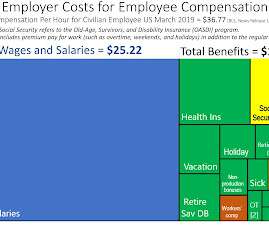

One of the few things that taxpayers can do to reduce their income taxes after a calendar year ends is to make a tax-deductible contribution to a traditional individual retirement account (IRA) or a SEP-IRA (for small business owners and/or their employees). 401(k), 403(b), 457, or Thrift Savings Plan). There is no way out.

Let's personalize your content