3 Reasons to Boost Your Employee Benefits Offerings in 2020

Achievers

DECEMBER 16, 2019

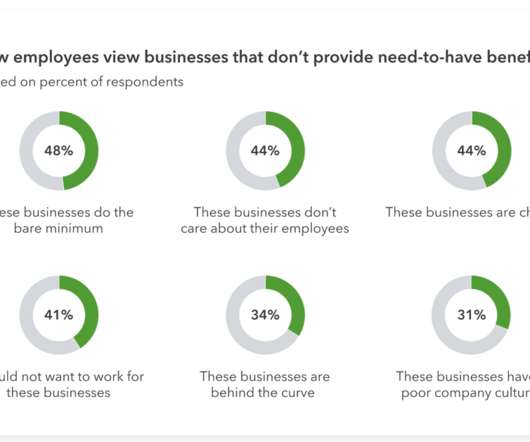

And for 75 percent, a good benefits package would make them take one job over another,” says a recent employee health benefits survey by QuickBooks Payroll. Vision coverage. A matching 401(k) or pension. “For 41 percent of small business employees, benefits are crucial when accepting a new job, second to salary.

Let's personalize your content