Financial Planning Tips for Older Women

Money Talk

MARCH 24, 2022

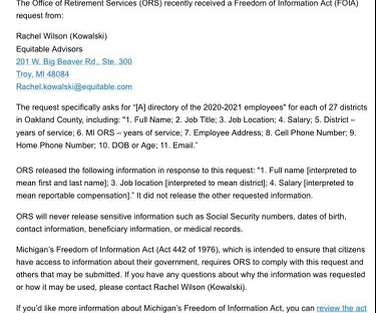

saving for later life in an IRA or 401(k) plan) while older women need “through retirement” goals. Sources of Retirement Income - Income sources include Social Security, employer defined-benefit pensions or defined-contribution retirement plans (e.g., 401(k)s), tax-deferred accounts (e.g.,

Let's personalize your content