Importance of Employee Benefit Package And Why it Matters

HR Digest

MAY 21, 2023

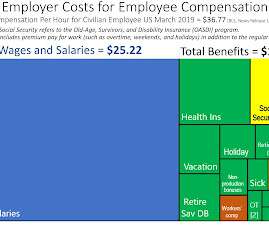

Overtime pay 3. Matching 401(k) contributions 2. Pension or retirement savings plan 3. Offers like a 401(k) or 403(b) can work as this means that people can use some of their money before they pay taxes on it, and invest in the future. Payroll taxes 2. Workers’ compensation 4. Mandatory leave 5.

Let's personalize your content