Total Compensation Report Statements: Unveiling the Value Beyond the Paycheck – Sample Included

COMPackage

NOVEMBER 3, 2024

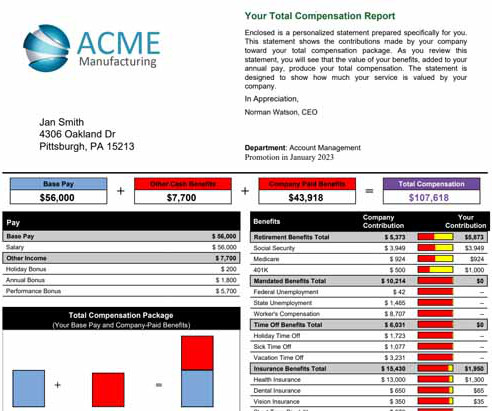

Benefits: A detailed breakdown of employer-sponsored benefits like health insurance, paid time off (PTO), retirement plans, and wellness programs. Salaried Workers: Focus on annual salary, bonus potential, retirement plan options, and detailed benefit summaries.

Let's personalize your content