10 Best Payroll Software in India (2024): - Top Solutions Reviewed

Vantage Circle

JUNE 3, 2024

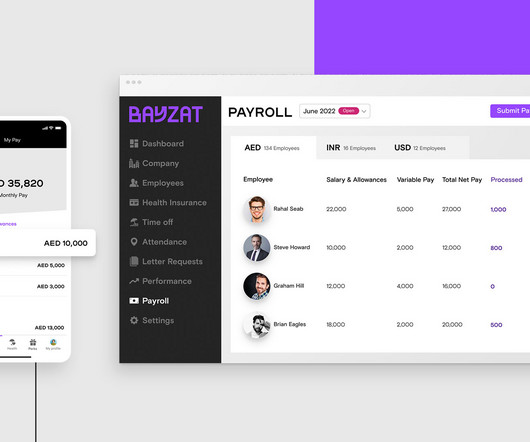

What is Payroll Software? Payroll Software automates managing employee salaries, wages, bonuses, and deductions. Payroll software typically includes features such as tax calculation, direct deposit, employee self-service portals, and integration with other HR and accounting software.

Let's personalize your content