Are Your Benefits Enough to See Employees Through a Crisis?

InterWest Insurance Services

OCTOBER 31, 2024

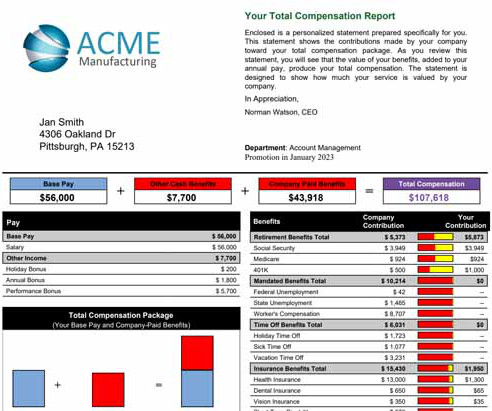

A recent survey by benefits provider Guardian indicates that families in this category are struggling when it comes to achieving their financial goals. Over 80% of middle-market respondents report that they got their health insurance, disability insurance and retirement plan all through their employer.

Let's personalize your content