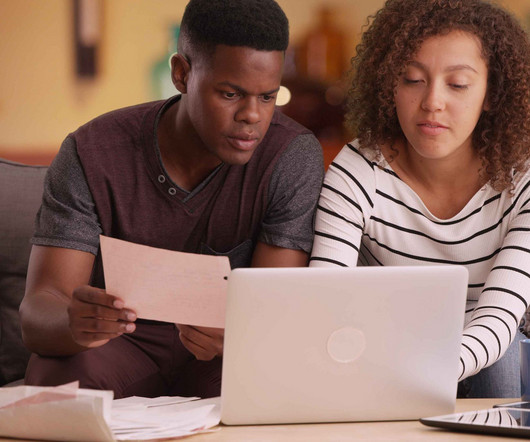

Are Your Benefits Enough to See Employees Through a Crisis?

InterWest Insurance Services

OCTOBER 31, 2024

A recent survey by benefits provider Guardian indicates that families in this category are struggling when it comes to achieving their financial goals. But many employers cap life insurance benefits at $50,000 — the maximum figure that allows employers to deduct premiums as a workplace benefit under IRC 7702.

Let's personalize your content