Why Should HRs Invest in Payroll HRMS for Businesses?

Qandle

FEBRUARY 12, 2025

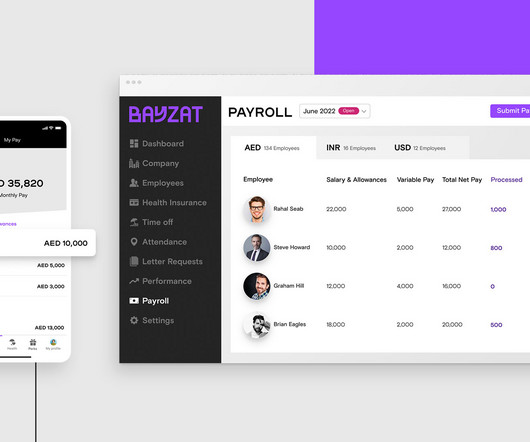

It integrates various functions like employee attendance, salary calculation, tax management, benefits administration, and statutory compliance, all within one unified platform. Payroll involves multiple steps, including calculating employee salaries, withholding taxes, processing deductions, and generating payslips.

Let's personalize your content