How HRMS Reshapes Payroll Management for Companies

Qandle

SEPTEMBER 20, 2024

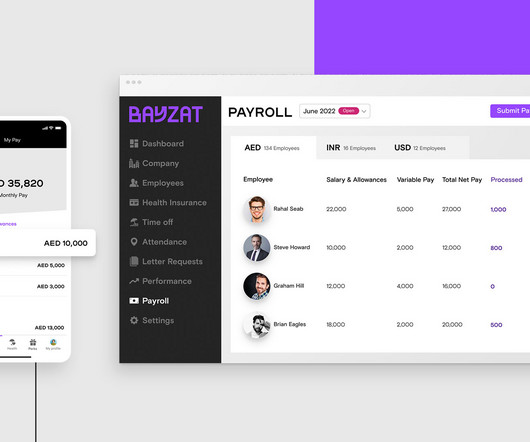

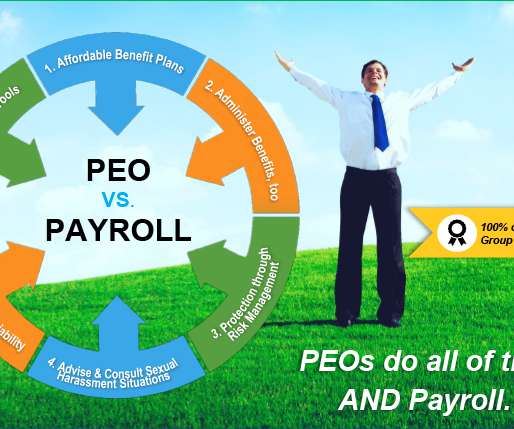

HR services cover the full employee lifecycle, including recruitment, onboarding, training, and performance management, while also handling employee relations and regulatory compliance. Payroll services ensure accurate and timely payment of wages, managing deductions, benefits, and tax withholdings.

Let's personalize your content