What is Equity Compensation & How It Work?

HR Lineup

APRIL 19, 2024

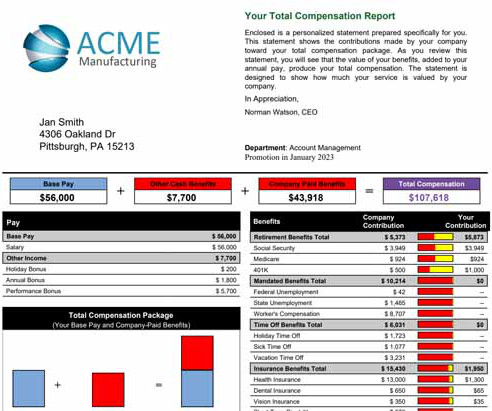

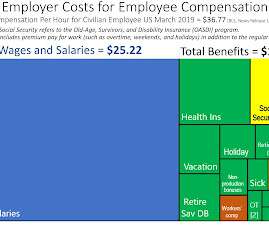

Equity compensation is a powerful tool used by companies to attract, retain, and incentivize employees. Unlike traditional forms of compensation such as salary and bonuses, equity compensation grants employees ownership stakes in the company.

Let's personalize your content