EXECUTIVE COMPENSATION

HR Management Activities

AUGUST 1, 2023

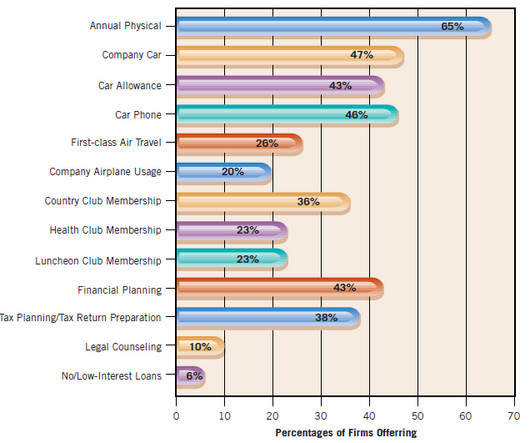

Many organizations, especially large ones, administer executive compensation somewhat differently than compensation for lower-level employees. An executive typically is someone in the top two levels of an organization, such as Chief Executive Officer (CEO), President, or Senior Vice-President.

Let's personalize your content