What is Employee Poaching & How to Deal With It?

HR Lineup

JULY 20, 2024

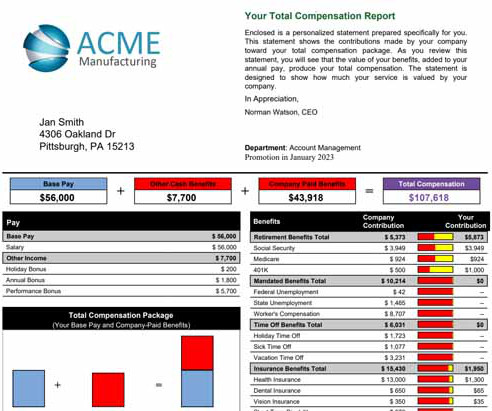

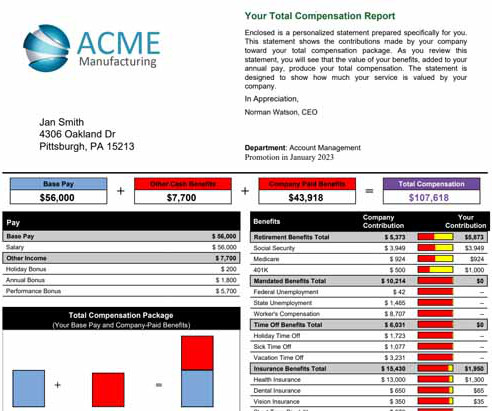

Attractive Offers: Higher Compensation: To entice employees to leave their current positions, poaching companies often offer significantly higher salaries, bonuses, or other financial incentives. This often involves confidential meetings and communications. Poaching companies must navigate these legal constraints carefully.

Let's personalize your content