Fingercheck

HR Lineup

JULY 17, 2023

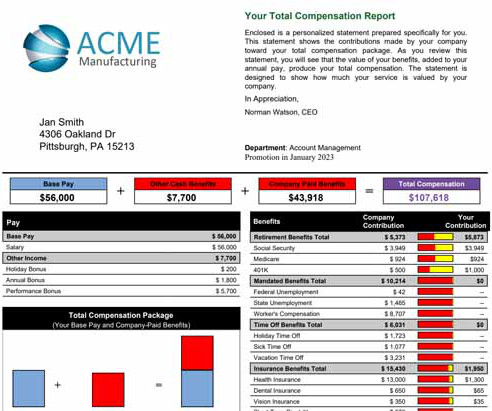

It supports various pay types, including hourly, salaried, and commission-based, and can handle complex pay structures and deductions. Fingercheck also keeps track of paid time off (PTO) and provides comprehensive reports, ensuring accurate and timely payroll processing.

Let's personalize your content