How to Create a Pay Stub for Employees?

HR Lineup

JANUARY 29, 2024

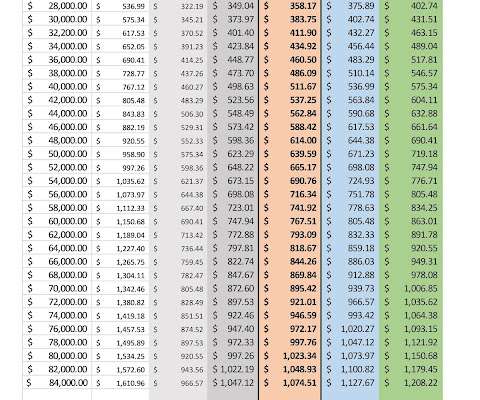

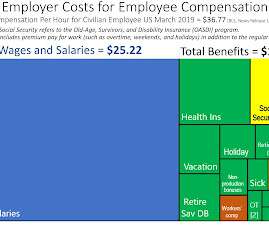

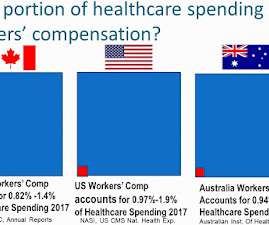

A pay stub not only serves as a record of an employee’s earnings but also provides crucial information about deductions, taxes, and other financial details. Earnings: Gross wages Overtime pay Bonuses or commissions Reimbursements 3. These tools often come with additional features like tax calculations and direct deposit.

Let's personalize your content