Top 5 reasons to check your payslip

cipHR

NOVEMBER 15, 2021

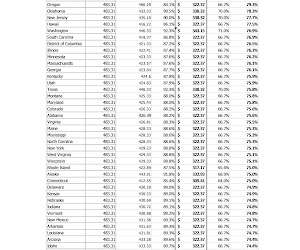

This means people can earn £12,500 tax-free, and only start paying tax on income over that amount. However, if they have any other form of income, get benefits-in-kind from their employer (health insurance, life insurance or a company vehicle etc) or claim tax relief for any other reason, it will affect this tax code.

Let's personalize your content