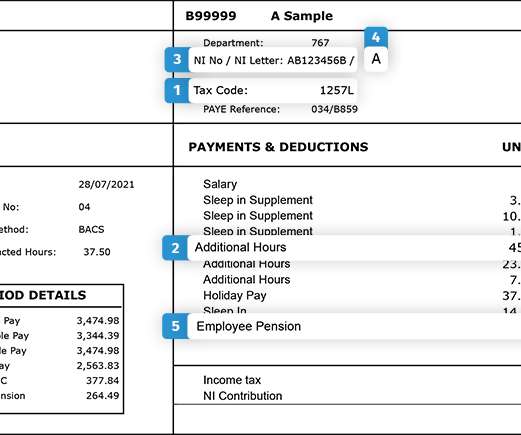

Top 5 reasons to check your payslip

cipHR

NOVEMBER 15, 2021

Despite their importance for keeping track of our pay, as many as one in twelve people (8%) admit that they rarely (or never) look at them. CIPHR asked payroll expert Jon Lee for some pointers. A lot of payroll queries come from people who think they’ve paid too much tax in a particular month. So, why should we?

Let's personalize your content