Employee value proposition in action: Compelling real-world examples

Business Management Daily

AUGUST 12, 2024

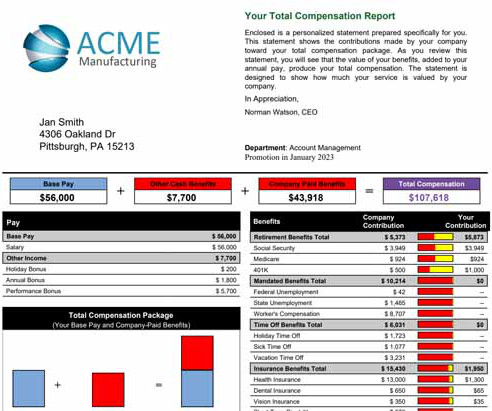

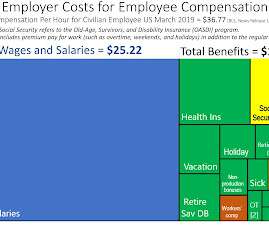

Top talent with more specialized skills and training will expect more from their employers, such as higher salaries, more perks, and flexibility around remote work. Compensation includes the employee’s hourly wage or salary, along with added forms of payment like commissions or bonuses.

Let's personalize your content