Employee retention strategies… the trick to keeping your talent

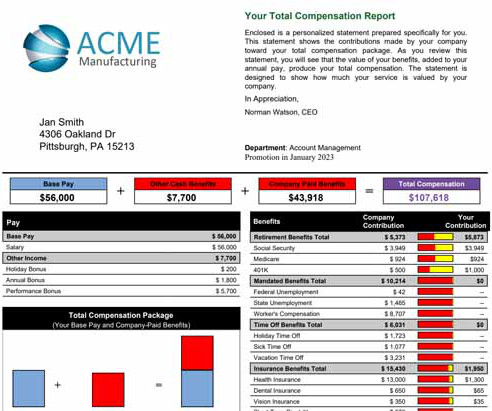

Employee Benefits

FEBRUARY 26, 2024

Employee retention is an ongoing theme for employers and HR professionals, and for good reason. It’s more cost-effective to invest in employee retention strategies than it is to attract, onboard and train new starts. Are you at high risk of high employee turnover? Creating an enviable company culture Values matter.

Let's personalize your content