What is Global Payroll?

HR Lineup

SEPTEMBER 25, 2023

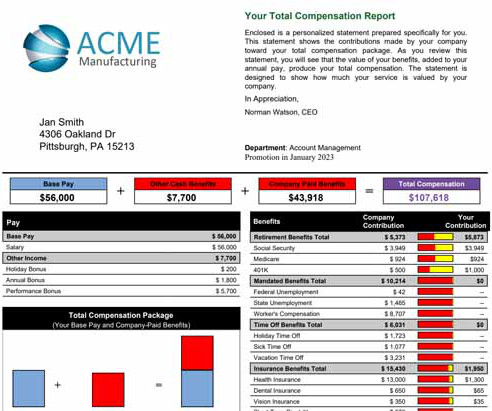

Global payroll refers to the process of managing employee compensation , tax compliance, and other related financial responsibilities across international borders. Integration with HR and Finance Systems: Integrating global payroll with other systems, such as human resources and finance, is essential for efficiency and accuracy.

Let's personalize your content