What Is a Qualified Retirement Plan?

HR Lineup

MARCH 13, 2022

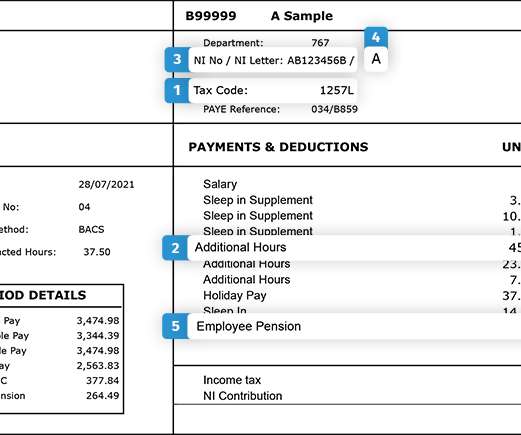

However, the tax deduction is limited to a maximum of 25% of the total salary of the employees in this qualified employee benefit plan. As an employer, your contributions towards a qualified plan are tax-deductible. Hybrid plan. Target benefit plans. Profit-sharing plans. Money purchase plans.

Let's personalize your content