Top 5 reasons to check your payslip

cipHR

NOVEMBER 15, 2021

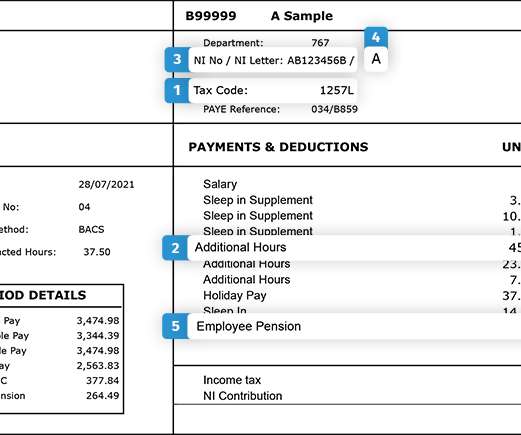

Tax codes can, and do, change, particularly if there’s been a change of personal circumstances, such as people getting married, claiming taxable state benefits, or working from home. This means people can earn £12,500 tax-free, and only start paying tax on income over that amount. Personal details. Pension payments.

Let's personalize your content