What is Human Resource Outsourcing?

HR Lineup

JULY 6, 2023

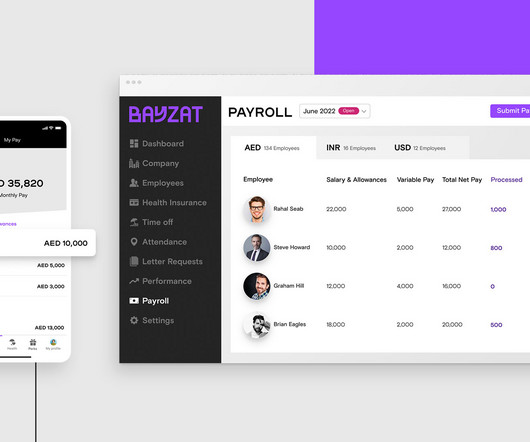

This type of outsourcing is particularly beneficial for organizations that require large-scale hiring or lack internal recruitment capabilities. Payroll Outsourcing: Payroll is a critical HR function that involves the calculation of employee salaries, tax deductions, and compliance with local labor laws.

Let's personalize your content