What is Global Payroll?

HR Lineup

SEPTEMBER 25, 2023

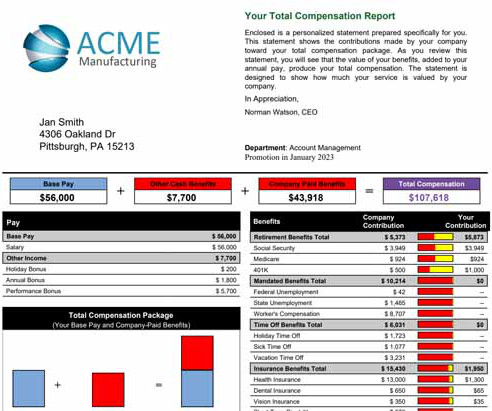

Global payroll refers to the process of managing employee compensation , tax compliance, and other related financial responsibilities across international borders. Effective global payroll not only ensures legal compliance but also contributes to employee satisfaction, cost efficiency, and informed decision-making.

Let's personalize your content