Employees and Employers Save with Cafeteria Plans

InterWest Insurance Services

OCTOBER 27, 2022

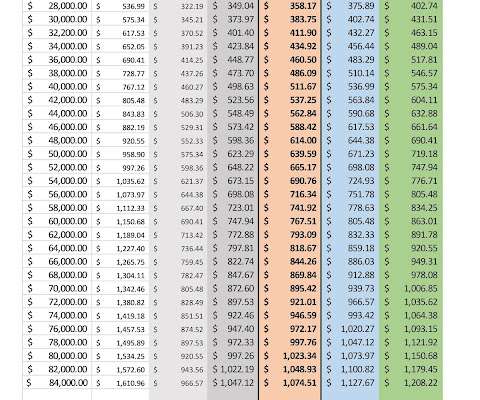

These cafeteria plans, which are governed by Section 125 of the Internal Revenue Service Code, allow your employees to withhold a portion of their pre-tax salary to cover certain medical or childcare expenses. Employees can save an average of 30% in federal, state and local taxes on items they already pay for out of pocket.

Let's personalize your content