5 Emerging Benefits Trends to Look for in 2025

Best Money Moves

DECEMBER 9, 2024

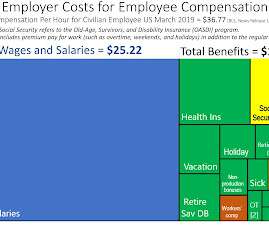

Compared to years prior, employees are more interested in retirement benefits and paid leave opportunities. One method of support employers are providing will come in the form of affordable deductibles. According to the report, 40% of large companies will offer a medical plan with a low or no deductible.

Let's personalize your content