Things to Learn From a Tax Return

Money Talk

AUGUST 8, 2024

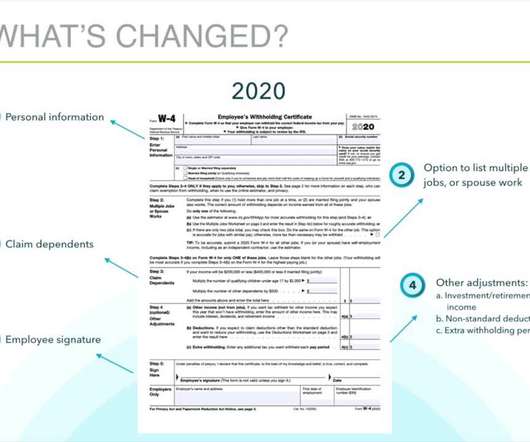

With less than five months remaining in 2024, now is the time to begin serious tax planning for your 2024 income tax return. I recently attended a webinar with some tips for financial advisors about reviewing clients’ tax returns. Simply look at your 2023 tax return and divide your total tax owed by taxable income.

Let's personalize your content