How flexible working hours, competitive pension benefits, and mental wellbeing support can engage the Gen Z workforce

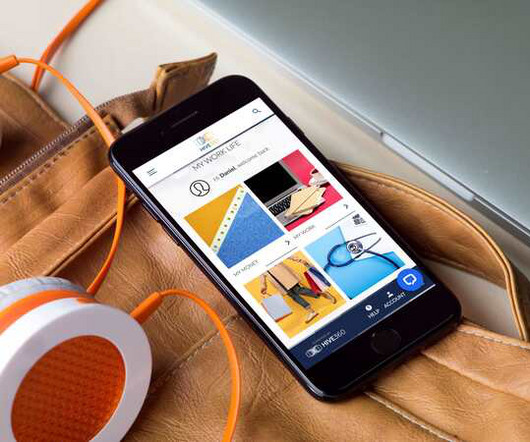

Employee Benefits

JANUARY 22, 2024

In our newest report, ‘Zooming in on Gen Z’, we compiled our findings from ‘ The Benefits Factor ’ to discover what Gen Z expects from employers. Here, we’re sharing the five benefits your organisation must provide to become a Gen Z magnet. However, this doesn’t mean that Gen Z craves solely remote work.

Let's personalize your content