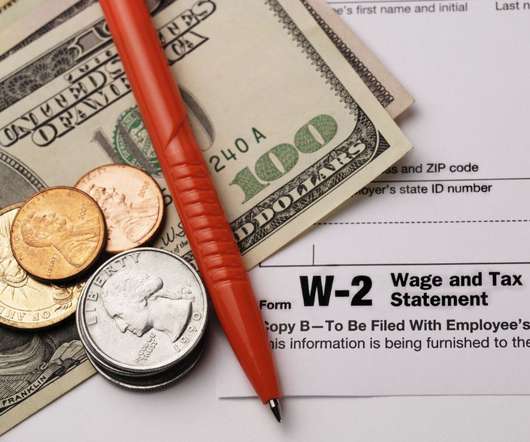

Role of Payroll Software in Eliminating Compliance Risks

Qandle

JANUARY 29, 2025

Payroll software is essential in this situation. In this blog, well explore how payroll software can help organizations eliminate compliance risks, streamline payroll processes, and provide peace of mind for HR professionals and business owners. Looking for the Best Payroll Software ?

Let's personalize your content