Total Compensation Report Template: Track, Analyze, and Optimize Employee Compensation

COMPackage

SEPTEMBER 30, 2024

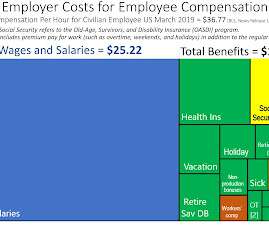

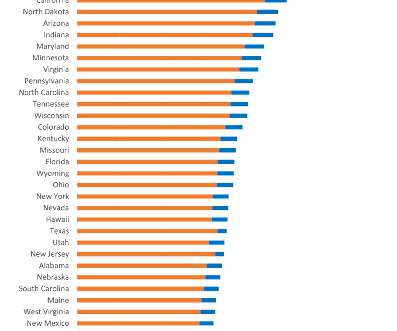

Total Compensation Report Template: Track, Analyze, and Optimize Employee Compensation A total compensation report template is a valuable tool for HR departments, providing a comprehensive overview of an employee’s compensation package.

Let's personalize your content