6 Key HSA Benefits to Communicate to Employees

Flimp Communications

OCTOBER 30, 2024

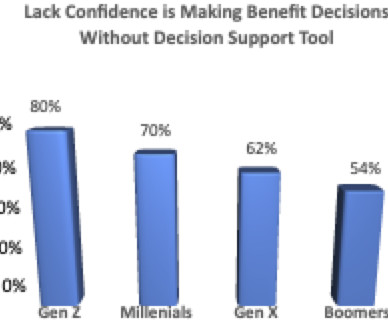

Their tax advantages and investment potential can help employees reduce healthcare costs, save for retirement, and maximize tax refunds. And yet, that’s not how most employees understand them — if they understand them at all. Higher HSA enrollment and usage can take a bite out of your company’s FICA taxes.

Let's personalize your content