Gross vs. Net Pay: What’s the Difference?

Patriot Software

AUGUST 29, 2022

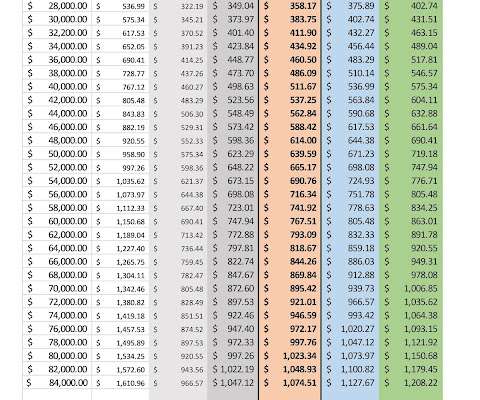

Although it’s natural to have payroll questions when starting out, you can’t afford to get tripped up when it comes to gross vs. net pay. Knowing the difference between gross and net pay impacts employee wages, payroll withholdings, recordkeeping, and even employer laws.

Let's personalize your content