Mindy Zatto is helping employers build the right retirement plan

Employee Benefit News

SEPTEMBER 18, 2023

Mindy Zatto, founding principal of Strategic Benefits Advisors, is on a mission to simplify and demystify retirement plans.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Employee Benefit News

SEPTEMBER 18, 2023

Mindy Zatto, founding principal of Strategic Benefits Advisors, is on a mission to simplify and demystify retirement plans.

HR Lineup

MARCH 13, 2022

Types of Qualified Retirement Plans. There are three classes of qualified retirement plans, namely: 1. Defined benefits plan. In a defined benefit plan, an employer pays a predetermined amount at either termination of employment or retirement. Hybrid plan. Target benefit plans.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

HR Lineup

JULY 20, 2024

Better Benefits : Enhanced benefits packages, including health insurance, retirement plans, paid time off, and other perks, are commonly used to lure employees. Confidentiality and Discretion: Secrecy: Poaching efforts are typically conducted discreetly to avoid alerting the current employer and to minimize legal risks.

WEX Inc.

NOVEMBER 21, 2024

Employers leveraging data-driven platforms to offer customized options will stand out regarding employee recruitment and retention. Many employees now prioritize flexibility in healthcare, retirement savings, and wellness programs. Employers should prepare for potential changes in healthcare policy, retirement plans, and wage laws.

HR Lineup

SEPTEMBER 24, 2024

Hire-to-Retire (HTR) refers to the comprehensive employee lifecycle management process that spans from the moment an individual is recruited until they retire or exit the organization. Offer and Negotiation: Extending job offers, negotiating salaries and benefits, and finalizing employment agreements.

HR Lineup

SEPTEMBER 28, 2024

Benefits Administration: Tracks and manages employee benefits, such as health insurance, retirement plans , and leave policies. An HRIS (Human Resource Information System) is employee-centric, designed to handle various aspects of employee management and administration throughout the entire employment lifecycle.

Best Money Moves

JANUARY 14, 2025

Depending on the individual, this could mean anything from contributing to their retirement to getting out of debt. However, one throughline remains when it comes to relieving employee stress, many employees are looking to their employers to provide the necessary educational resources. This is an area with growth opportunities.

HR Lineup

MARCH 31, 2023

One of the biggest challenges is managing the employer-employee relationship, and this is where Employer of Record (EOR) and Professional Employer Organization (PEO) services come in. Additionally, both EOR and PEO services allow employers to focus on their core business functions, as they take care of all the HR-related tasks.

Money Talk

DECEMBER 27, 2024

The latter is when an investment downturn occurs early in retirement, people need to sell shares for living expenses, and funds are no longer available for a rebound. Also, with tax-deferred retirement plans subject to RMDs, savers are in a partnership with the IRS.

Business Management Daily

AUGUST 13, 2024

Your employers are highly impressed with your capabilities and don’t want to lose you to a competitor. This is how employers’ trap’ top-performing employees into staying at their organizations, which is why the term ‘golden handcuffs’ is used. Picture this.

HR Lineup

SEPTEMBER 20, 2024

Employee resentment refers to negative feelings that individuals develop toward their employers, colleagues, or the workplace itself. Beyond salaries, inadequate benefits like health insurance, paid time off, and retirement plans also contribute to dissatisfaction. What Is Employee Resentment?

Best Money Moves

JANUARY 7, 2025

Moreover, employees view their employers as responsible for financial wellness efforts. According to MetLifes Employee Benefit Trends Study 2024 , 92% of employees want more consistent care from their employers. Additionally, retirement plan coverage for smaller businesses (under 100 employees) may reach parity with larger companies.

Best Money Moves

AUGUST 19, 2024

However the way that stress manifests often comes as a surprise to employers. The Qualified Plan Advisors’ 2024 Financial Wellness Survey found that 68 percent of the American workforce experiences financial stress, with respondents reporting a surprising range of negative symptoms. 31% of employees struggle with sleep disturbances.

WEX Inc.

JUNE 13, 2023

And baby boomers are actually the highest percentage of retirement-account holders among any group segmented in a 2021 survey by the U.S. This lack of retirement planning by large segments of employees is leading to more stress for them and less productivity at work. Independence to make your own decisions in your retirement.

HR Lineup

APRIL 11, 2023

Employment is a significant part of our lives, and it comes with various benefits and perks. Employee benefits are non-wage compensations that are provided by employers to their employees, which may include health insurance, retirement plans, and vacation time. One of these benefits is the provision of employee benefits.

Bayzat

JULY 15, 2024

To achieve this, employers should create a comprehensive well-being program that addresses both physical and mental health, encourage a culture where taking sick leave is not stigmatized, ensure workloads are manageable, and promote work-life balance through flexible working hours.

HR Lineup

JUNE 20, 2023

In this guide, we’ll delve into the differences between new hire orientation and onboarding, their significance, and best practices for employers to ensure a smooth transition for their new hires. The post New Hire Orientation vs. Onboarding: A Complete Guide for Employers appeared first on HR Lineup. What is Onboarding?

Proskauer's Employee Benefits & Executive Compensa

JANUARY 3, 2023

was signed into law on December 29, 2022 , making it important for plan sponsors and plan administrators to familiarize themselves with the new rules. Correction of Retirement Plan Overpayments. changes how retirement plan overpayments are corrected in two key ways, which are detailed below.

Money Talk

JULY 25, 2024

The number of self-employed older adults has been steadily increasing in recent years driven by factors such as longer life expectancy, changing attitudes toward work in retirement, and technology advancements that enable remote work. They can be on Social Security and Medicare while earning money from self-employment.

WEX Inc.

JULY 24, 2023

Fortunately, there’s an often overlooked way to help employees build wealth and prepare for retirement. Why HSAs for retirement planning? These accounts provide another way for your employees to diversify their efforts to prepare for retirement. Click below to get your free HSA retirement white paper.

Employee Benefit News

FEBRUARY 12, 2025

High ESA adoption rates are linked to both increased average employee contributions and decreased retirement plan withdrawals.

Best Money Moves

AUGUST 6, 2024

Employees often look to their employer as a source of financial wellness support. Yet only 28% of employers report offering such benefits to their teams. Whether it be retirement planning or securing a mortgage, Best Money Moves can guide employees through the most difficult financial times and topics.

HR Digest

JANUARY 7, 2025

Image: Pexels Employers Need to Take Note of These Upcoming Trends in Employee Benefits The kind of employee benefits offered by an employer can make or break the companys retention numbers. Employers are leveraging advanced analytics and AI-driven platforms to curate benefits ecosystems that adapt to individual needs.

Employee Benefit News

OCTOBER 31, 2024

Companies can provide better financial literacy to help older couples, who are separating, make smart decisions with their money.

HR Lineup

MARCH 10, 2022

Nonqualified deferred compensation (NQDC) plans are among the benefits employers use to retain top talent , and if you are wondering what they are, this article clarifies everything. In addition, you will understand the benefits and risks of implementing NQDC plans so that you can put them to the best use for your business. .

Best Money Moves

JULY 15, 2024

Here are the best ways employers can help. Nearly 1 in 5 say they’d like their employer to offer debt management benefits, according to a Georgetown University and Bank of America study, And when it comes to younger employees with outstanding debt, 1 in 3 say they’d like their employer to offer debt management benefits.

HR Lineup

DECEMBER 22, 2021

With an effective compensation plan, your employees will be comfortable and satisfied, thus working long term. A good compensation plan also attracts quality talent and builds your employer brand, thus attracting more clients and investors. This resource focuses on making retirement planning as easy as possible.

InterWest Insurance Services

OCTOBER 31, 2024

Over 80% of middle-market respondents report that they got their health insurance, disability insurance and retirement plan all through their employer. But many employers cap life insurance benefits at $50,000 — the maximum figure that allows employers to deduct premiums as a workplace benefit under IRC 7702.

WEX Inc.

OCTOBER 2, 2024

HSA-eligible health plans typically have lower premiums but higher deductibles. Assess your ability to cover the deductible before choosing this plan. Funds you or your employer contribute to your HSA can help with this. Watch the video to hear more from our own Jason Cook about the retirement-planning potential of an HSA.

Business Management Daily

AUGUST 12, 2024

As an employer or human resources manager, consider what candidates and employees bring to your business. Offering solid benefits and a compelling employer value proposition can help attract top talent and increase employee engagement and retention rates. But what do you give them in exchange?

Money Talk

JUNE 16, 2022

If you picture retirement planning and taxes as a Venn Diagram, there is lots of overlap between these two areas of personal finance. This is true both during one’s working years (when taxpayers are saving for retirement) and later, when people are older and withdrawing taxable income from tax-deferred accounts.

Money Talk

MAY 9, 2024

I love to play pickleball), or some other aspect of your life without incorporating your job title or employer. Be Realistic About Retirement Age - Retirement age is an important assumption in retirement planning and can happen earlier than expected. workers retire earlier than expected.

HR Lineup

MAY 28, 2024

These programs go beyond the traditional healthcare and retirement plans, incorporating elements that cater to employees’ holistic well-being. Employee perks, also known as employee benefits or fringe benefits, are additional incentives provided by employers to their employees beyond their regular salaries or wages.

Money Talk

MAY 11, 2023

I recently attended three webinars related to retirement planning. One discussed required minimum distribution (RMD) rules, the second, retirement planning in general, and the third, the FIRE ( F inancial I ndependence, R etire E arly) movement. Time will tell if workers save more money and have more income in retirement.

Best Money Moves

JULY 24, 2024

For employers, the right financial benefits help attract talent and keep their workforce satisfied. However, despite these concerns, financial wellness programs may go overlooked among the other, more common benefits an employer may provide. We have robust benefits options for employers, regardless of their benefits budget.

HR Lineup

APRIL 10, 2023

HR professionals are responsible for managing employee benefits programs, such as health insurance, retirement plans , and paid time off. HR professionals also manage employee benefits programs, such as health insurance , retirement plans, and paid time off. How do HR Support Employees? How do HR Support Employees?

Money Talk

APRIL 20, 2023

One of my Money Talk clients is my long-time employer, Rutgers Cooperative Extension. My segment of their six-week class series was called Can Farmers Ever Afford to Retire? Benefits are based on a worker’s 35 highest earning years and delayed retirement credits between full retirement age and age 70 increase benefit amounts.

HR Digest

AUGUST 30, 2024

The strike began following FTC hearings in relation to a merger between Albertsons and Kroger , Fred Meyer’s parent company, but the issues between the union and the employer were ramping up even before the details of the merger planted disharmony between them.

McDermott Will & Emery Employee Benefits

OCTOBER 11, 2023

Act codifying an opportunity for employers to provide matching contributions within a tax-qualified retirement plan based on their employees’ qualified student loan payments outside the plan. student loan benefit and other employer options for […] The post Employer Student Loan Debt Benefits Following SECURE 2.0

Employee Benefits

JUNE 3, 2024

Alongside this, it improved its offer to employees through the defined contribution (DC) scheme, including increasing the core employer contributions significantly and introducing additional matched contributions up to 12%. The post Howdens provides staff with valuable retirement-planning tools appeared first on Employee Benefits.

International Foundation of Employee Benefit Plans

MAY 3, 2023

Research shows that one of the key hurdles for achieving retirement security is having access to a retirement plan at work.

Money Talk

APRIL 6, 2023

Savings Fosters Success - Studies have shown that just being in the retirement system in some capacity (e.g., participating in an employer savings plan and/or IRA) increases the odds of having a successful retirement (i.e., 401(k) plans), they generally don’t save for retirement.

Best Money Moves

MAY 10, 2022

5 benefits for employers to retain and attract top talent. High turnover creates an expensive problem for employers and stressful environment for employees. According to a survey by ArmadaCare, 78% of employees are more willing to stay with their employer due to their employee benefits. . According to SHRM, about ?

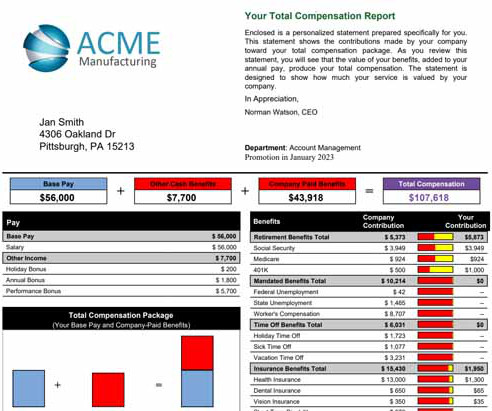

COMPackage

NOVEMBER 5, 2024

Employees increasingly seek a clear understanding of the complete value proposition their employer offers, going beyond just base salary. Benefits: A detailed breakdown of employer-sponsored benefits like health insurance, paid time off (PTO), retirement plans (including company contributions), and wellness programs.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content