6 steps to designing a great employee benefits program

Achievers

JUNE 6, 2022

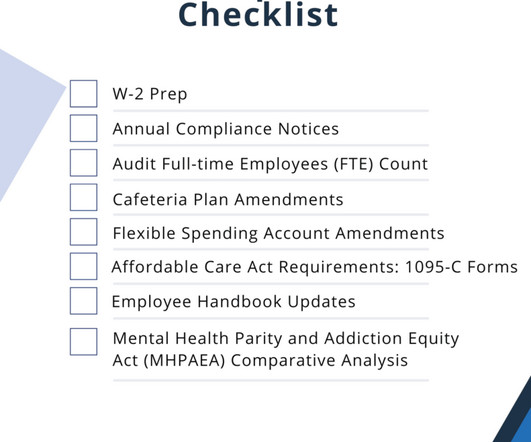

Traditional offerings like health insurance and retirement plans are likely the first things that come to mind. It’s easy to get this information directly from your team with an employee engagement solution that lets them provide honest feedback on which benefits they appreciate and which they could do without.

Let's personalize your content