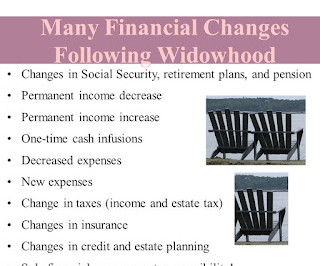

Planning Ahead for Widowhood: Changed Income and Expenses

Money Talk

SEPTEMBER 12, 2024

This is a 40% “haircut,” which some couples cover with spousal gifts, annuities, and/or life insurance. A car might be sold, thereby reducing costs for loan payments, gas, and auto insurance. In addition, less food is needed and the cost of the deceased’s health insurance ends.

Let's personalize your content