Inflation Insights and Work-Arounds

Money Talk

MARCH 18, 2022

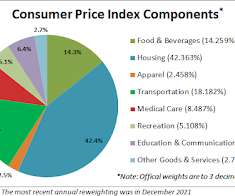

For example, how much more you are paying for gas, utilities, and food than you did a year ago? Substitute to Save: Non-Food Items - Consider purchases of clothing, furniture, housewares, electronics, and more at thrift shops, garage sales, and online sales platforms such as Facebook Marketplace, Etsy, Craigslist, Nextdoor, and eBay.

Let's personalize your content